stock options tax calculator usa

Even taxpayers in the top income tax bracket pay long-term capital gains rates. NSO Tax Occasion 1 - At Exercise.

Understanding How The Stock Options Tax Works Smartasset

Non Qualified Stock Options Calculator.

. Ad Calculate Your Potential Investment Returns With the Help of AARPs Free Calculator. This permalink creates a unique url for this online calculator with your saved information. Section 1256 options are always taxed as follows.

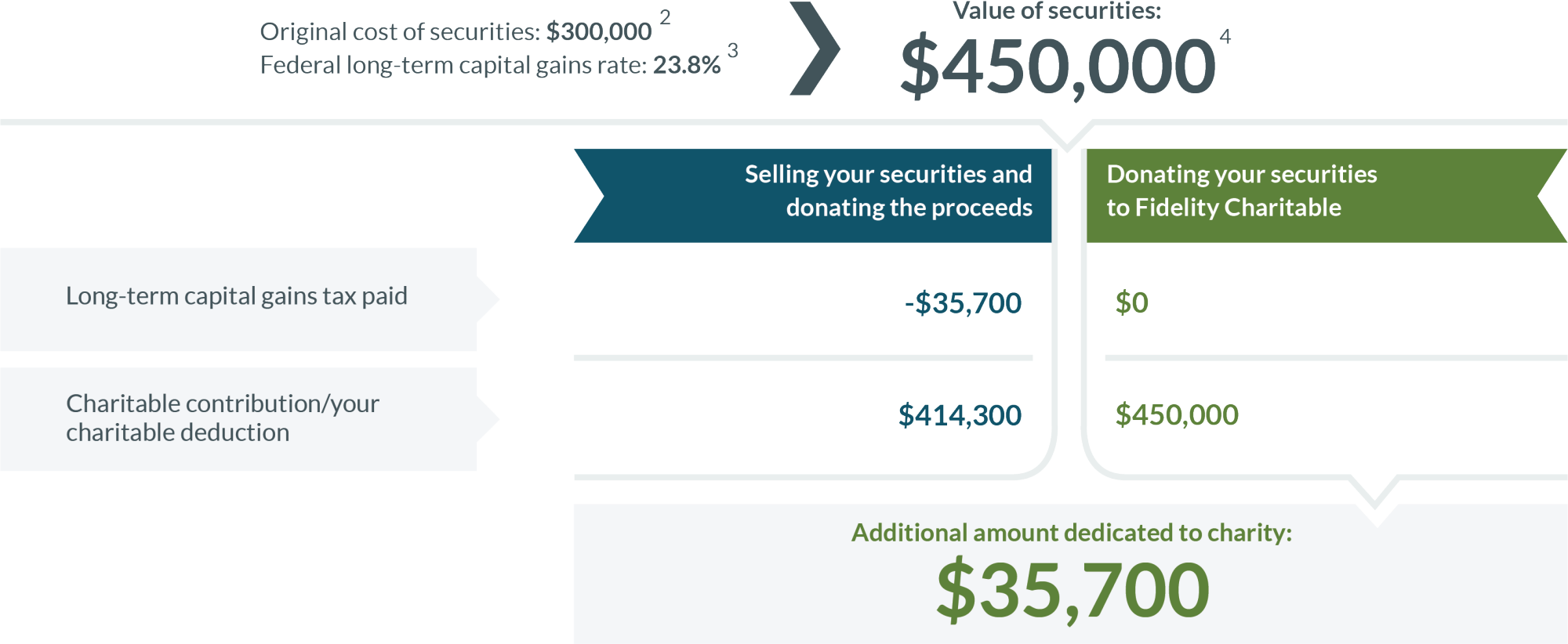

Nonqualified Stock Options NSOs are common at both start-ups and well established companies. The Stock Option Tax Calculator shows the costs to exercise your stock options including taxes based on your companys current valuation. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term.

Attend an upcoming free. This is ordinary wage. Additionally your marital status also influences your tax rate.

On this page is a non-qualified stock option or NSO calculator. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Ordinary income tax and capital gains tax.

40 of the gain or loss is taxed at the short-term capital tax. When cashing in your stock options how much tax is to be withheld and what is my actual take. The same property or stock if sold within a year will be taxed at your marginal.

Ad Smart Options Strategies shows how to safely trade options on a shoestring budget. In fact some companies eg. 16000 - 15000 1000 taxable income.

Nonqualified Stock Option NSO Tax Calculator. When you exercise the option you include in income the fair market value of the stock at the time you acquired it less any amount you paid for the stock. Once youve opened it you need to provide the initial value at which the asset was bought the sale value at which you have sold it and the duration.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share of. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. How much are your stock options worth.

In our continuing example your theoretical gain is. The Employee Stock Options Calculator For use with Non-Qualified Stock Option Plans. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

60 of the gain or loss is taxed at the long-term capital tax rates. On this page is an Incentive Stock Options or ISO calculator. Using the united states tax calculator is fairly simple.

Stock Options Tax Calculator Usa. Tax exemption on the first 2000 of gains and exemption of 25 of. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two.

The Free Calculator Helps You Sort Through Various Factors To Determine Your Bottom Line. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Download Smart Options Strategies free today to see how to safely trade options.

There are two types of taxes you need to keep in mind when exercising options. This is an online and usually free calculator. Click to follow the link and save it to your Favorites so.

Vesting us stock options while living outside of the us. The Stock Option Plan specifies the total number of shares in the option pool. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in.

The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

2022 2023 Tax Brackets Rates For Each Income Level

100k Iso Limitation On Qualified Stock Option Grants

Credit Karma Tax Vs Turbotax Which Is Better For Filing Taxes

Rsu Taxes Explained 4 Tax Strategies For 2022

Ultimate Crypto Tax Guide 2022 Koinly

Ultimate Crypto Tax Guide 2022 Koinly

Secfi Stock Option Tax Calculator

Understanding The Tax Implications Of Stock Trading Ally

Alternative Minimum Tax Wikipedia

The Mystockoptions Blog Stock Options

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)